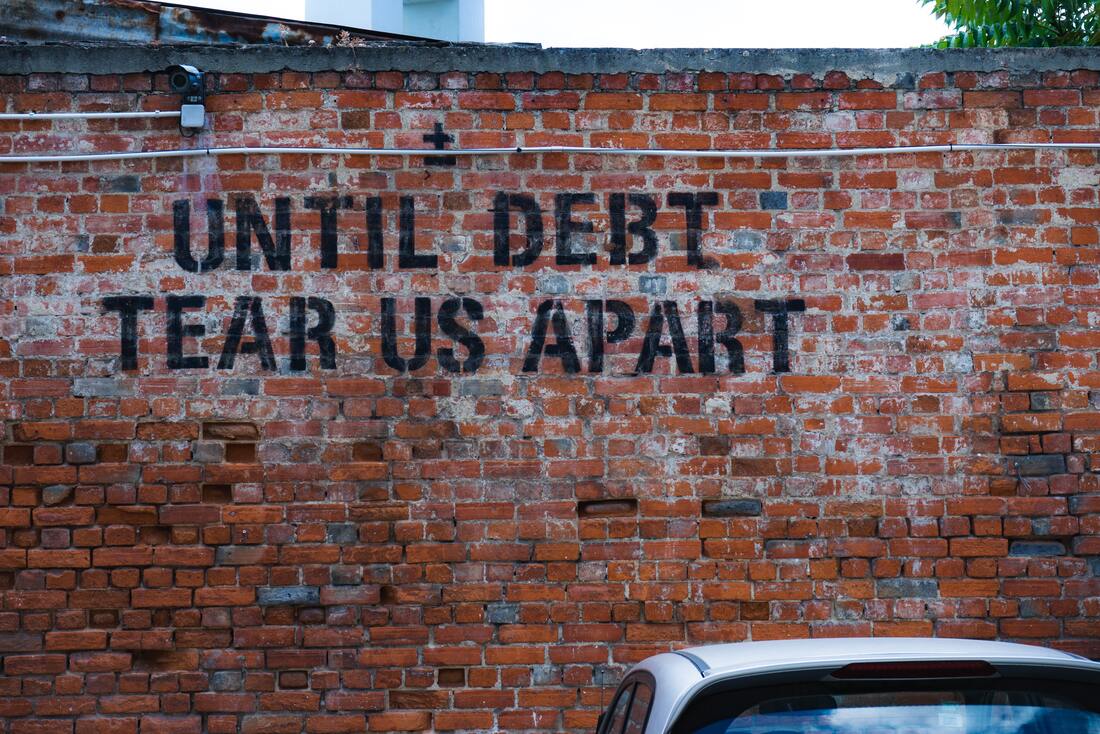

Photo by Ehud Neuhaus on Unsplash Photo by Ehud Neuhaus on Unsplash

There are thousands of debt service companies nationwide. Finding the right one can be a little frightening, But, it’s very important that you take the time to find a reputable debt relief company. This type of company needs to have the knowledge, experience, and ability to provide the level of serve you expect and the results you deserve.

Don’t make a rash decision. Choosing a bad debt service increases the probability that further damage will be caused to your personal credit file. Now, on the other hand, choosing a good debt service can be the best financial decision of your life. It can dramatically help to dramatically clean up your personal credit file and improve your credit score. When making your decision make sure to consider items beyond the price of the service. You need to recognize the difference between price and value while seeking assistance from a company in the credit repair industry. Remember that “you get what you pay for.” The following paragraphs will explain the 4 types of debt service companies that make up the industry and what you can expect from each:

Debt Service Type 1:

The first type of debt relief company is typically a one-person home office type of deal. In general, this type of debt service advertises extremely low rates and will usually have unbelievable service guarantees to top it off. It is not uncommon for this type of debt relief organization to be a complete scam and take the consumers' money without providing any service at all. Moreover, if you are dealing with a debt service that falls into this category you are lucky if the only thing you lose is your money and not your identity in the process. Unless you know the debt service company to be reputable, you should think twice before handing over your personal identification information. While not all debt relief companies that fall into this category are scams, it is very common for the individual running this type of company to be completely unaware of the compliance all credit repair companies must adhere to. This company will typically use 3 or 4 standard dispute letters that are extremely generic and not intended to be used in every situation. Although using standard dispute letters may provide some level of positive results, their use also has the potential to further damage your credit. Moreover, the use of standard dispute letters usually only provide temporary results, as the negative information removed from your personal credit file will most likely reappear on your credit file the next time it is reported by the creditor.

Debt Service Type 2:

The second type of debt relief company appears to be more legitimate. This type of company will have a physical office but similar to debt service company type 1, they only use the same standard dispute letters mentioned above. Although this operation is not illegal, compliance issues are usually overlooked. The largest difference between debt service company type 1 and 2 is that the second usually makes use of an inexpensive software program that allows it to produce volume and handle clients on a much larger scale. They use extremely generic letters, and for that reason will not get the best results possible. Although this type of debt relief company may do a large amount of business, they are not setup to handle consumers that have specific credit related problems. This type of credit repair company uses more of a cookie-cutter approach. The first two types of credit repair companies mentioned make up for more than 90% of the debt relief industry. Debt service company type 3 and 4 are completely different and make up for less than 10% of the industry. It is very important to note the differences. Debt Service Type 3: The third type of debt relief company is usually compliant with the laws governing credit restoration organizations, and it is well versed in the U.S. Code used to dispute negative credit items on the consumer's credit file. Using more than just standard dispute letters, this type of company can be much more effective than the first two. Because this type of debt service company has such a good understanding of the U.S. Code related to credit, it is typical for this type of company to offer custom credit repair work to its clients. The ability to provide custom work for its clients allows this type of company to go above and beyond the level of service provided by the first two types of credit repair companies.

Debt Service Type 4:

The 4th type of debt relief company is very much like the third type in that it is usually compliant with federal law, extremely well versed in the U.S. Code, required to be effective in the credit repair industry, and typically also offers to perform custom dispute work for its clients. The largest difference between debt service company type 3 and 4 is that credit repair company type 4 has attorneys on staff or is contracted with a law firm. Debt service company type 4 will also usually be more expensive than the other three credit repair company types but will almost always be more effective. Not only can an attorney based credit repair organization provide the best results possible, but a credit restoration organization that has attorneys on staff or is contracted with a law firm can also enforce the consumers' rights should legal action be required to correct inaccurate items on a consumer's personal credit file. Beyond that, by using an attorney based debit service company, the consumer can minimize the possibility that an item will be re-reported by a creditor as an attorney has the ability to take additional steps to block negative items from being re-reported on a consumer's personal credit file. There are very few debt service companies that fall into this category. As you can see, it is not only important to find a debt service company that is staffed with experts and has the ability to provide great results, but it is also very important to find one that is compliant with the guidelines set forth by the federal government. You should now understand the benefit of using a credit repair company that has attorneys on staff or is contracted with a law firm. Your credit report can greatly help in determining your financial future than most anything else. You should not put your credit report in the hands of just anyone. Choose a debt service company that is compliant, well versed in the related U.S. Code, staffed by experts and attorneys or employs the services of a law firm. Article Source: [http://EzineArticles.com/?All-Credit-Repair-Companies-Are-Not-Created-Equal&id=3530273]All Credit Repair Companies Are Not Created Equal Disclaimer: The videos, posts, and comments contained in our *Health & Weight Loss Categories* on this website are not medical advice or a treatment plan and are intended for general education and demonstration purposes only. They should not be used to self-diagnose or self-treat any health, medical, or physical condition. Don’t use this website to avoid going to your own healthcare professional or to replace the advice they give you. Consult with your healthcare professional before doing anything contained on this website.

0 Comments

Leave a Reply. |

|