Photo by Thirdman from Pexels Photo by Thirdman from Pexels

Cleaning up your credit can be a difficult process. However if you take the steps toward your credit clean up you can be on your way to a brighter financial future. One good way on the road to success in building strong finances is to to add or refine the starter or good accounts you currently have. Starter accounts are those smaller credit or loan accounts that people with no credit are usually able to get in order to start building credit. These accounts are smaller in limit and don’t require the high level of credit that other loans, like credit cards and home loans, do. These are good accounts not only for those just starting out in their credit journey, but also for those recovering from bankruptcy and other financial set backs.

0 Comments

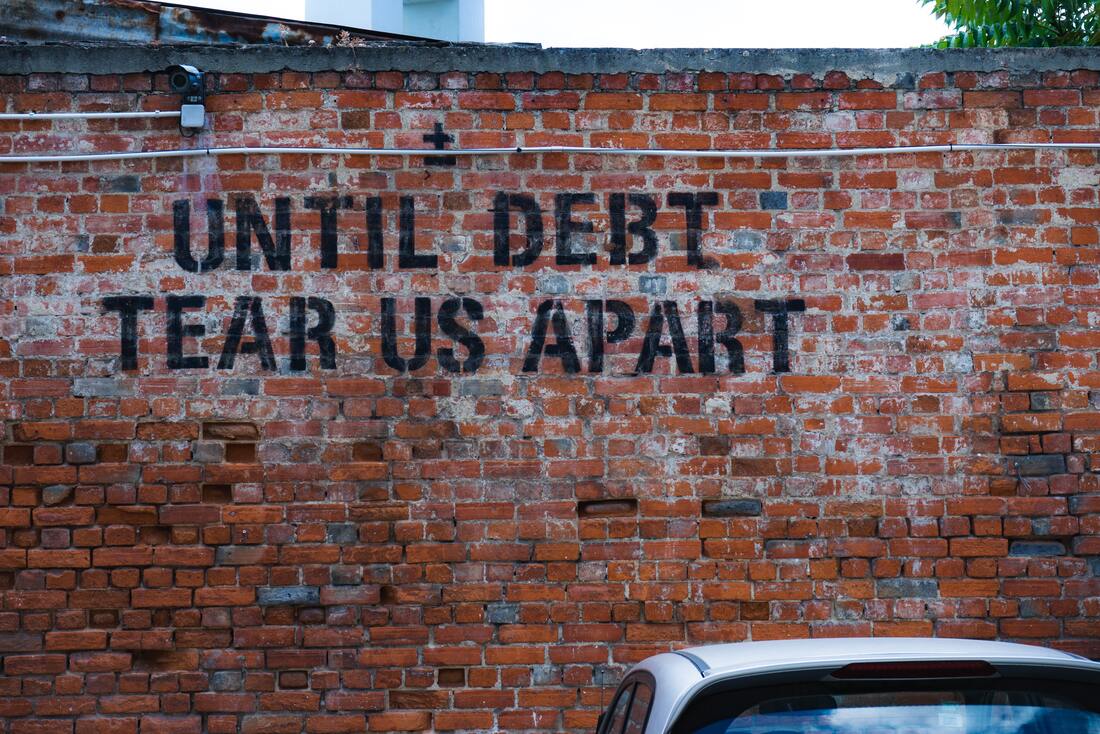

Photo by Ehud Neuhaus on Unsplash Photo by Ehud Neuhaus on Unsplash

There are thousands of debt service companies nationwide. Finding the right one can be a little frightening, But, it’s very important that you take the time to find a reputable debt relief company. This type of company needs to have the knowledge, experience, and ability to provide the level of serve you expect and the results you deserve.

Don’t make a rash decision. Choosing a bad debt service increases the probability that further damage will be caused to your personal credit file. Now, on the other hand, choosing a good debt service can be the best financial decision of your life. It can dramatically help to dramatically clean up your personal credit file and improve your credit score. When making your decision make sure to consider items beyond the price of the service. You need to recognize the difference between price and value while seeking assistance from a company in the credit repair industry. Remember that “you get what you pay for.” The following paragraphs will explain the 4 types of debt service companies that make up the industry and what you can expect from each: |

|